But to really speak the language of the C-suite and prove your department's value, you need to get comfortable with the two most important numbers in business: revenue and profit. People often toss these terms around as if they're the same thing, but they tell two completely different stories about your company's health.

The core difference between revenue vs profit is actually pretty simple. Revenue is the total cash a company pulls in before a single expense is paid. Profit is what’s left in the pot after every single cost is subtracted. It's entirely possible for a business to boast massive, multi-million dollar revenues and still be deep in the red if its costs are out of control. Getting this distinction right is the first step toward showing how your team directly impacts the bottom line.

What Are Revenue and Profit in Customer Service?

Let's break down what these terms mean for a customer experience leader. Shifting your focus from purely operational metrics to financial ones helps align your department's goals with the company's overall strategy.

What Is Revenue?

Think of revenue as the "top line" on an income statement. It's the raw, total amount of money your company generates from sales before any costs get deducted. In a CX context, revenue can be directly linked to your team's efforts, like when an agent successfully upsells a customer to a premium plan or when exceptional service prevents a high-value client from churning.

The formula is as straightforward as it gets:

- Revenue = Sales Price x Number of Units Sold

This number is a powerful gauge of your company's scale and market demand. When the top line is growing, it means your products are resonating with customers and you're gaining traction.

What Is Profit?

Profit, often called the "bottom line," is the money that remains after subtracting every single business expense from your total revenue. We're talking about everything—agent salaries, software licenses, office rent, marketing campaigns, you name it. Profit is the truest measure of a company's financial health and operational efficiency.

The basic formula is:

- Profit = Total Revenue - Total Costs

A high-revenue customer service operation isn't automatically a profitable one. Profitability demonstrates that you are not just making sales, but you are managing operational costs effectively to ensure long-term stability.

Going a step further, mastering revenue recognition principles is essential for accurately reporting your company's financial performance. This ensures you're looking at numbers that align with standardized accounting practices, giving you a reliable view of your department's contribution.

Revenue vs. Profit At a Glance

To make the distinction crystal clear, here’s a quick side-by-side comparison.

| Attribute | Revenue Focus | Profit Focus |

|---|---|---|

| Definition | Total income generated before any expenses are deducted. | Net earnings remaining after all expenses are subtracted. |

| Financial Statement Location | Appears at the top of the income statement. | Appears at the bottom of the income statement. |

| What It Indicates | Market penetration, sales volume, and business growth potential. | Operational efficiency, financial health, and long-term sustainability. |

| Primary Goal | Maximizing sales, expanding customer base, and increasing market share. | Optimizing costs, improving margins, and increasing overall efficiency. |

This table neatly sums it up: revenue shows your potential, while profit shows your actual performance. Both are critical, but they guide very different strategic decisions for a CX leader.

A Deeper Dive into Financial Metrics

While it’s easy to talk about the top line (revenue) and the bottom line (profit), true strategic insight comes from peeling back the layers of profitability. Not all profit is created equal. For a customer service leader, understanding the difference between gross, operating, and net profit shows exactly where your department’s budget hits the company’s financial statements.

This nuanced view shifts the conversation from just "managing expenses" to strategically optimizing them. It clarifies how your decisions directly influence the company’s ability to survive, thrive, and reinvest in growth.

Understanding Gross Profit

Gross profit is the very first layer of profitability you'll see on an income statement. It's calculated by taking your total revenue and subtracting the Cost of Goods Sold (COGS). COGS are the direct costs tied to actually making your product or delivering your service.

For a SaaS company, COGS might include things like server hosting fees and essential third-party software licenses. For an e-commerce business, it’s the wholesale cost of the physical products you sell. Critically, customer service costs are almost never included here, which makes gross profit a pure measure of how profitable the core product is before any other business overhead gets factored in.

Focusing on Operating Profit

This is where you, as a CX leader, really enter the financial picture. Operating profit is what’s left after you subtract both COGS and operating expenses (OpEx) from revenue. Your department's entire budget—every salary, every software license, every training session—falls squarely into OpEx.

Operating expenses are all the costs needed to keep the lights on and run the day-to-day business. For a CX department, this includes:

- Agent Salaries and Benefits: This is almost always the biggest line item.

- Contact Center Software: Your CRM, ticketing systems, and telephony platforms are all significant operational costs.

- Training and Development: The budget you fight for to upskill your team directly hits the operating profit.

- Office Rent and Utilities: For in-house teams, these facility costs are part of the OpEx puzzle.

Because your budget directly reduces this number, operating profit is the most accurate reflection of your team’s financial efficiency. A healthy operating profit shows that the core business isn't just viable, but it's also being managed effectively day-to-day. To get a better handle on these crucial financial metrics, check out this definitive guide on ROAS vs. ROI, which explores related concepts for measuring performance.

Revenue gauges your market penetration, but profit measures your operational health. This distinction is critical; a business can generate massive revenue but have a weak operating profit if its day-to-day costs, like those in customer service, are not well-managed.

Tracking the right operational metrics is the key to improving this figure. You can explore the top 10 customer service KPIs to track in 2025 to see exactly how performance metrics connect to financial outcomes.

The Final Tally: Net Profit

Finally, we get to net profit—the ultimate bottom line. This is the cash left over after every single expense has been paid. That means COGS, operating expenses, plus other costs like interest on business loans and corporate taxes.

While a CX leader has little direct control over things like interest rates or tax policy, understanding net profit gives you the complete picture of the company’s overall financial health. A positive net profit means the company is truly in the black. This is the money that can be used to reinvest in new projects, pay out dividends to shareholders, or simply build up cash reserves for a rainy day.

By understanding these three tiers of profit, you can speak the language of the C-suite and articulate your department's value with much greater precision. You can show how an investment in new training (an operating expense) could reduce costly escalations, thereby improving operating profit and ultimately contributing to a healthier net profit for the entire organization. This financial literacy elevates your role from a cost center manager to a strategic business partner.

How Revenue and Profit Shape Key CX Decisions

Knowing the difference between revenue and profit isn't just a financial exercise for the CFO's office. It's the strategic lens that dictates every major decision you make as a customer experience (CX) leader. Whether your C-suite prioritizes growing the top line or protecting the bottom line will shape how you build your team, invest in technology, and structure your entire support operation.

A revenue-focused mindset sees the CX department as a growth engine. A profit-focused mindset, in contrast, views CX as a center of operational excellence where efficiency and cost management are king. Neither approach is better than the other, but aligning with your company's current financial stage is absolutely critical.

Staffing Models: Revenue Growth vs. Profit Efficiency

Your staffing model is one of the clearest reflections of your financial priorities. The fundamental question shifts from "How many agents do we need?" to a much more strategic one: "What role do our agents play in our financial strategy?"

A revenue-focused leader will almost always justify a larger team to keep customer wait times at zero and jump on every opportunity for an upsell or cross-sell. The logic is straightforward: every missed call or long chat queue is a potentially lost sale.

In this model, you might find yourself:

- Hiring more agents than your forecast demands just to handle unexpected spikes.

- Investing heavily in sales-through-service training programs.

- Building out specialized teams dedicated to converting inquiries into sales or retaining high-value customers.

A profit-focused leader, on the other hand, scrutinizes headcount as the single largest operational expense. The objective here is to handle customer interactions as efficiently as possible to protect those precious margins. Every agent has to deliver maximum value, and staffing is built on lean, mean principles.

This strategy often involves:

- Using workforce management (WFM) software to forecast demand with surgical precision, avoiding overstaffing at all costs.

- Focusing training on first-contact resolution (FCR) and shaving seconds off handle times.

- Implementing tiered support systems where simple issues are deflected to self-service channels first.

Technology Investments: Driving Sales or Cutting Costs

Technology is another battleground where the revenue vs. profit dilemma plays out. The software and tools you choose will either be geared toward empowering agents to sell more or equipping them to resolve issues faster.

Let's say your company is considering a new AI chatbot.

- Revenue Focus: The business case will be all about the chatbot's ability to engage prospects 24/7, qualify leads, and hand off warm conversations to live sales agents. Success is measured by the number of new leads generated and the uptick in conversion rates.

- Profit Focus: The argument shifts to the chatbot’s power to deflect common, repetitive questions away from human agents. The key metric here isn’t leads, but the reduction in support tickets and the corresponding drop in labor costs, which directly improves operating profit.

A revenue-first strategy invests in tech that creates new customer conversations. A profit-first strategy invests in tech that automates or resolves existing ones, freeing up human agents for high-value, complex issues.

This same logic applies to everything from your CRM platform to analytics tools and quality assurance software. Every single investment must be justified by its contribution to either top-line growth or bottom-line health.

Outsourcing and BPO Decisions

The decision to outsource customer service is a classic balancing act of financial goals. Business Process Outsourcing (BPO) can be a powerful lever for both generating revenue and protecting profit—it all depends on how you wield it.

A revenue-driven approach to BPO might involve partnering with a provider that offers specialized multilingual support, allowing you to enter new international markets almost overnight. The goal is to capture global revenue without the long, expensive process of hiring in-house.

Conversely, a profit-driven strategy often uses BPO to tap into labor markets with lower operational costs, slashing the overall cost to serve. It's all about leveraging economies of scale to boost efficiency and protect margins. The constant challenge, however, is keeping a lid on the hidden costs that can slowly erode those savings.

This dynamic is even visible at a national economic level. The UAE's economy, for example, shows how revenue streams and cost pressures interact. When lower oil prices shrank the trade surplus, a record surplus in the services sector helped absorb the shock. Yet, constant cost drags, like remittance outflows from migrant workers, consistently eat into margins—much like the ongoing operational overheads in a BPO partnership. You can learn more about these economic shifts in the PwC Middle East Economy Watch.

Ultimately, aligning your CX decisions with the company’s primary financial goal—be it aggressive growth or sustainable profitability—ensures your department is not just a support function but a strategic contributor to long-term success.

Balancing Growth and Efficiency in Your Operations

Every business leader wrestles with the classic tug-of-war between top-line growth and bottom-line health. It's a constant balancing act. The old "growth at all costs" mindset often creates unsustainable service models that just burn through cash, putting customer acquisition ahead of long-term stability. Knowing when to hit the gas on revenue versus when to pump the brakes and focus on profit is what separates a flash-in-the-pan from a company built to last.

This isn't a one-time decision. It’s a strategic choice that hinges entirely on where your company is right now. A scrappy startup trying to carve out market share has wildly different priorities than an established player looking to fine-tune its operations.

When to Prioritize Revenue Growth

For businesses in a high-growth phase, a revenue-first approach makes a lot of sense. When the main goal is capturing market share, building brand recognition, or scaling up to land investors, bringing in as much top-line income as possible is the name of the game.

In this mode, a CX leader's mission is simple: eliminate any friction that could possibly lose a sale. This usually means:

- Aggressive Staffing: Hiring more agents to keep wait times near zero, offering 24/7 support, and having specialists on standby for sales-related questions.

- Generous Policies: Rolling out flexible return policies or offering deep discounts to lock in new customers and start building that initial loyalty.

- Investment in Acquisition Channels: Funneling money into tools and teams for pre-sales chat, social media engagement, and proactive outreach.

This strategy is a bet on the future. You're accepting a higher cost-to-serve today with the expectation that these new customers will become profitable over their lifetime.

When to Shift Focus to Profitability

As a business matures, or when economic headwinds start blowing, the spotlight has to move from pure growth to sustainable profit. At this point, you've established your market, and the key to sticking around is operational efficiency and a healthy balance sheet.

A focus on profitability isn't about cutting corners; it's about making smarter, more efficient use of your resources to ensure the business can thrive for years to come. It’s a shift from 'doing more' to 'doing what matters, better.'

For a CX leader, this means putting every cost under the microscope and optimizing every single process. The playbook includes:

- Investing in Automation: Deploying AI chatbots and self-service portals to handle the high-volume, low-complexity tickets, which frees up your human agents for the tough stuff.

- Process Optimization: Digging into workflows to shave down average handle time (AHT) and boost first-contact resolution (FCR), driving down the cost of each interaction.

- Strategic Outsourcing: Looking at BPO partnerships to manage costs more predictably. For a deeper analysis, check out our guide on evaluating the cost savings of outsourced vs. in-house support teams.

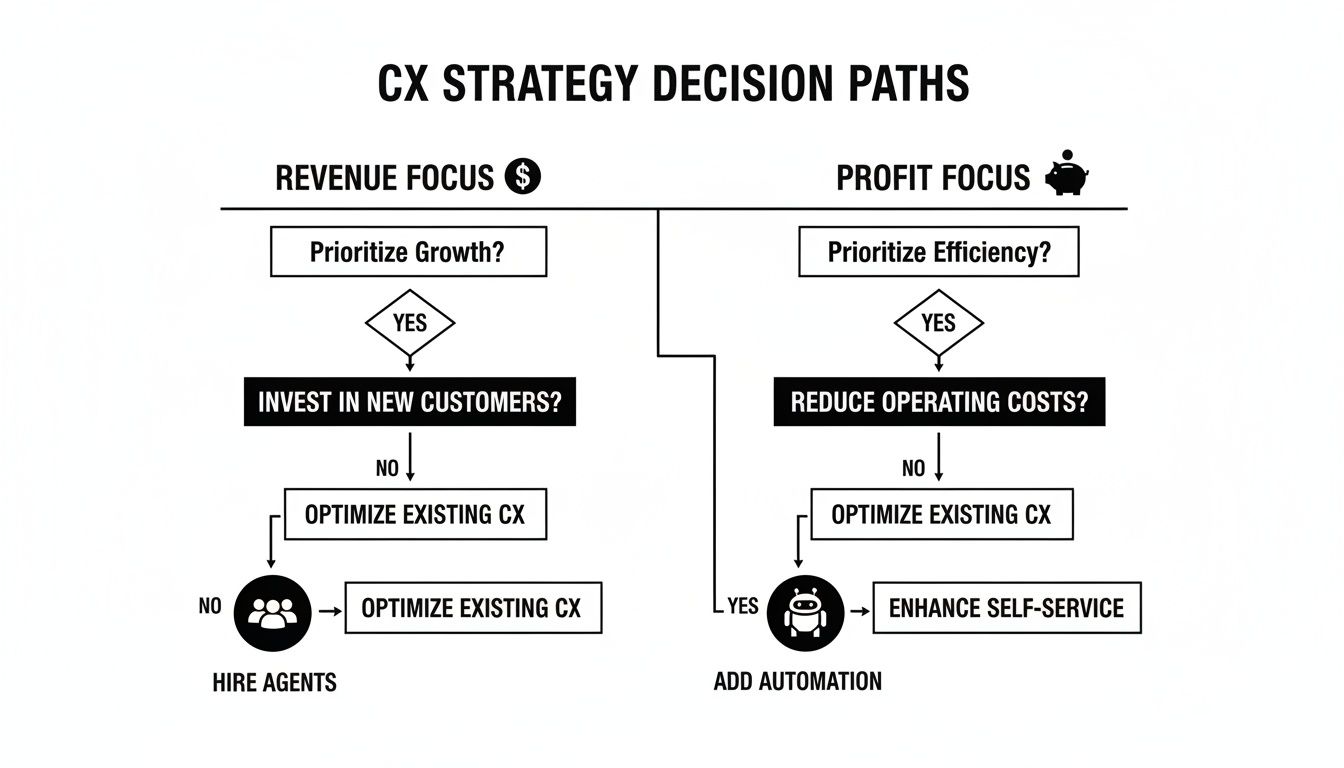

This flowchart breaks down the strategic paths a CX leader can take depending on which financial metric is the priority.

The decision tree really boils down to a fundamental choice: do you invest in more people to drive revenue, or do you implement technology to protect your profit margins?

Learning From Large-Scale Economic Trends

You can see this delicate balance between revenue and profit play out across entire industries. The aviation sector in the Middle East offers a fascinating real-world example. Regional airlines there are on track to post a staggering net profit of $6.2 billion, with a world-leading net profit margin of 8.7 percent. They're achieving this even as global passenger revenue is set to hit a record $693 billion, proving that massive revenue doesn't automatically translate to strong profits everywhere else.

While Middle Eastern carriers are pocketing a profit of $27.20 per passenger, the global average is a measly $7.20. This stark difference shows how operational efficiency and regional economic advantages can turn high revenues into incredible profitability.

This case study demonstrates that even when revenue growth is constrained, a relentless focus on costs and efficiency can deliver phenomenal financial results. For CX leaders, the takeaway is crystal clear: aligning your operational strategy with the company’s financial stage is how you prove your department’s value and contribute to lasting success.

Your CX Financial Health Playbook

Alright, let's move from theory to action. To really get a handle on the financial impact of your customer service department, you need a practical playbook. This means looking beyond purely operational metrics like CSAT and focusing on indicators that tie your team’s performance directly to the company's top and bottom lines.

A truly effective dashboard needs to track metrics that both drive revenue and protect profit. This dual focus ensures you aren't just bringing in new customers, but doing it in a way that’s financially sustainable. It gives you a clear, data-backed story to tell, which makes those budget conversations with the C-suite a whole lot more productive.

Essential KPIs for Balancing Revenue and Profit

To build a complete picture of your CX financial health, it helps to track a mix of metrics. Some will measure how well your team generates and holds onto income, while others monitor operational efficiency and cost-effectiveness. Here’s a breakdown of the KPIs that should be on every CX leader's radar.

| KPI | Primary Focus | What It Tells You | How to Measure It |

|---|---|---|---|

| Customer Lifetime Value (CLV) | Revenue | The total expected revenue from a single customer over their entire relationship with your company. | (Average Purchase Value) x (Average Purchase Frequency) x (Average Customer Lifespan) |

| Customer Retention Rate | Revenue | The percentage of customers who stick with you over a given period. | [(Customers at End of Period - New Customers) / Customers at Start of Period] x 100 |

| Upsell/Cross-sell Revenue | Revenue | The amount of additional revenue generated from existing customers through service interactions. | Sum of all revenue from upsells and cross-sells initiated by the service team. |

| Cost to Serve | Profit | The average cost of handling a single customer interaction. | Total Departmental Operating Costs / Total Number of Customer Interactions |

| First Contact Resolution (FCR) | Profit | The percentage of issues resolved in a single interaction, preventing costly follow-ups. | (Number of Issues Resolved on First Contact / Total Number of Issues) x 100 |

| Agent Utilization Rate | Profit | The percentage of an agent's paid time spent on customer-facing activities. | (Total Agent Time on Customer Interactions / Total Paid Agent Hours) x 100 |

These KPIs give you a balanced view, ensuring that your pursuit of revenue growth doesn't come at the expense of profitability. A high CLV is fantastic, but if your Cost to Serve is spiraling out of control, your department's net contribution is minimal. The goal is to find that sweet spot where growth and efficiency move in harmony.

A 4-Step Checklist for Aligning Your CX Strategy with Financial Goals

With the right KPIs on your dashboard, the next step is to translate that data into a cohesive strategy. This simple checklist provides a framework for making sure your day-to-day operations are locked in with the broader financial objectives of the business. You can learn more about how these efforts directly impact the ROI of investing in customer service in our detailed guide.

- Get a Grip on Your Costs. Start with a thorough review of every single expense in your department. Sort them into two buckets: essential (like agent salaries and core software) and discretionary (like perks or non-critical tools). This will help you spot immediate opportunities for optimization without hurting service quality.

- Connect Service Activities to Revenue. Map out every touchpoint where your team can influence a sale or prevent churn—from a pre-sales chat to a post-purchase support call. Quantify the financial impact of these interactions to build a clear business case for how your department directly contributes to revenue.

- Create Balanced Performance Targets. Don’t just incentivize your team on speed. Build a balanced scorecard for agents that rewards both efficiency (like a low average handle time) and effectiveness (like successful upsells or high CSAT scores). This stops agents from rushing through calls at the expense of revenue opportunities or customer satisfaction.

- Review and Adjust on a Regular Cadence. Your financial strategy can't be set in stone. Schedule monthly or quarterly reviews with your leadership team to analyze your KPIs, talk about what’s working, and pivot your strategy as needed. This agile approach keeps you perfectly aligned with the company’s ever-changing financial priorities.

Answering Your Key Financial Questions

As a CX leader, figuring out how to apply financial thinking to your day-to-day operations brings up some very real, practical questions. Let's break down some common challenges and connect the dots between revenue vs. profit and your team's actual impact.

Can a Customer Service Department Be a Profit Centre?

Historically, customer service got stuck with the “cost centre” label—a necessary expense that didn't directly bring in money. That view is completely outdated. With the right strategy, a modern CX department can absolutely become a profit centre, actively boosting the bottom line.

The switch happens when your team’s mission grows beyond just putting out fires. When agents are trained and motivated to spot upsell opportunities, prevent high-value customers from leaving, and collect product feedback that sparks innovation, they become direct drivers of financial growth.

Think about it: a skilled agent who talks a major customer out of churning has just protected thousands in future revenue. That's a profitable action. To prove it, you need to track metrics like Customer Lifetime Value (CLV) and revenue saved through your retention efforts. When you can put a dollar amount on your team's contributions, the conversation shifts from "expense" to "strategic investment."

What Is the First Step to Improving Departmental Profitability?

Before you dream up any grand strategies, the very first step is getting a brutally honest look at your costs. You can't improve profitability until you know exactly where every single dollar is going.

Start by auditing your entire budget. Don't just glance at the top-line numbers; break every expense down into clear categories:

- Labour Costs: This is always the biggest piece of the pie. It includes agent salaries, benefits, bonuses, and all your training expenses.

- Technology and Software: Make a list of every subscription, from your CRM and ticketing system to your QA and workforce management tools.

- Overhead Costs: If you run a physical contact centre, this covers rent, utilities, and equipment. For remote teams, it might be home office stipends or hardware allowances.

Once you have this detailed map, you can calculate your Cost to Serve—your total departmental cost divided by the total number of interactions. This single metric becomes your baseline. From there, you can easily spot inefficiencies like paying for software licenses nobody uses or being consistently overstaffed on Tuesday mornings. That's where you start making targeted changes that directly boost your department's contribution to profit.

The path to profitability doesn't start with grand strategies; it begins with a meticulous audit of your expenses. Understanding your cost structure is the foundation upon which all effective financial decisions are built.

How Do I Build a Business Case for New CX Technology?

To get the C-suite to sign off on new tech, you have to speak their language. That means focusing on profit-based outcomes, not just operational perks. An improved agent experience is great, but executives want to see a clear return on investment (ROI).

Forget listing features. Instead, build your case around these three financial pillars:

- Cost Reduction: How will this tool lower your operating expenses? For an AI chatbot, the argument is simple: it can deflect 30% of common inquiries. This reduces the immediate need for more agents and lowers your overall labour spend. You can quantify this by projecting the drop in your Cost to Serve.

- Revenue Generation: How will it help your team make more money? If you’re pitching a new CRM, show how its customer insights will help agents pinpoint and act on upsell or cross-sell opportunities. You can even project the potential increase in revenue per agent.

- Efficiency Gains: How will it make your current team more productive? A slick new knowledge base might slash Average Handle Time (AHT) by 15%. That means each agent can handle more interactions every day, allowing you to scale support without scaling your headcount at the same rate. This directly improves your operating profit.

When you frame the investment this way—linking it directly to improved profitability through cost savings and revenue growth—your proposal stops being a "nice-to-have" and becomes a strategic business decision.