At its core, the equation reveals how much profit you’re making for every dollar you spend or earn. Think of it as a quick, clear financial health check for your products, services, or your entire business.

So, What Is The Profit Percentage Equation?

I like to think of the profit percentage equation as a financial GPS. It doesn't just give you a single number; it shows you exactly where your business stands. This helps you navigate crucial decisions around pricing, cost control, and operational efficiency. Without it, you're driving blind, never quite sure if your strategies are leading to sustainable growth or just racking up silent losses.

But it's not a one-size-fits-all metric. There are two main ways to calculate it, and each one gives you a slightly different—but equally important—perspective on your company's performance. You really need to understand both to get the full picture.

The Two Core Profit Percentage Formulas

The main difference between the two formulas comes down to what you’re comparing your profit against: your initial cost or your final selling price. It seems like a minor detail, but it has a huge impact on everything from how you price your services to how you analyze your performance.

Here's a quick reference table breaking down the two main variations for easy comparison.

| Metric | Formula | What It Tells You |

|---|---|---|

| Profit on Cost (Markup) | (Profit / Cost Price) x 100 |

Shows how much your selling price is inflated from the cost. Perfect for setting prices based on expenses. |

| Profit on Selling Price (Margin) | (Profit / Selling Price) x 100 |

Reveals what percentage of your total revenue is actual profit. A key indicator of overall efficiency. |

By looking at profitability from these two angles, you get a much more balanced and insightful view. Here’s a quick rundown of what each formula tells you:

- Profit Percentage on Cost (Markup): This formula shows you exactly how much your selling price is "marked up" from what it cost you to produce or acquire something. It’s the go-to formula when you're setting prices based on your expenses.

- Profit Percentage on Selling Price (Margin): This version reveals what percentage of the final revenue is pure profit. It's a powerful indicator of your overall business efficiency and profitability.

A business can have a 100% markup on a product, but its profit margin will only be 50%. This critical distinction highlights why understanding both equations is crucial for accurate financial reporting and strategic planning.

When you're evaluating the financial impact of a big decision, like outsourcing your customer service, knowing your margin helps you see if the move is actually making your business more efficient. It lets you confirm whether the cost savings from outsourcing are translating into a healthier bottom line.

If you want to explore this concept further, this guide on what profit margin is is a great resource. Of course, to use these equations correctly, you first need a solid grasp of the basic components, which is why we put together a detailed breakdown on the key differences between revenue vs profit.

Understanding the Building Blocks of Profitability

Before you can confidently plug numbers into any profit percentage equation, you have to get a solid grip on its three core components: Revenue, Cost, and Profit. These aren't just accounting terms; they're the language of your business's financial health. If you get one of them wrong, your calculations will be flawed, leading to some seriously misguided decisions.

Think of it like baking a cake. If you mistake salt for sugar, the final result will be a disaster, no matter how perfectly you follow the rest of the recipe. The same logic applies here—getting your revenue or cost figures wrong makes your profit calculations completely useless. Let’s break down each element, especially as it applies to customer service operations.

Defining Your Revenue and Costs

For a customer service department, Revenue isn't always as clean-cut as a direct sale. It represents the total value your team either generates or protects for the business. This could be money from service contract renewals, upsells that your support agents initiated, or even the estimated dollar value of customers you kept from churning because of great service. It's the total financial upside tied to your CX efforts.

Cost, on the other hand, is everything you spend to deliver that service. This goes way beyond the obvious stuff, and you need to track it meticulously if you want an accurate profit picture.

- Direct Labor Costs: This is what you pay your people—salaries, benefits, and bonuses for your customer service agents and their direct managers.

- Software and Technology: Think of every subscription and license. CRM software, ticketing systems, phone platforms, and any AI tools you use all fall into this bucket.

- Overhead and Training: This covers everything from the physical office space to the programs you run for onboarding new hires and developing your team's skills.

- Outsourcing Fees: If you work with a Business Process Outsourcing (BPO) provider, their contract fees are a significant, direct cost.

The goal is to get a complete, no-stone-unturned list of all your expenses. Only by knowing the total investment can you accurately measure the return and calculate a profit percentage that actually means something.

The True Meaning of Profit

Once you have a firm handle on both revenue and costs, Profit is simply what's left over. It’s the clearest measure of your team’s operational efficiency. You just subtract your total costs from your total revenue.

A positive number is a win. A negative one is a red flag, telling you that your operational costs are higher than the value you’re generating.

Understanding every component of cost is critical for an accurate profit assessment, and that includes things like inventory carrying cost if your team deals with physical products. The details really matter, especially in the booming outsourcing market. For instance, the MEA outsourcing services market generated over USD 217 billion, with customer care BPO growing the fastest. This growth is fueled by CX leaders in places like the UAE who are seeing profit boosts of 18-30% by outsourcing their contact centers. It’s a perfect example of how strategically changing your cost structure can have a massive impact on your profitability.

How to Calculate Profit Percentage with Real Examples

Theory is one thing, but seeing the profit percentage equation in action is where it really clicks. Let's walk through a couple of real-world scenarios to show how this simple calculation can drive major strategic decisions, especially in a customer service setting.

We'll break down each example step-by-step, making it easy to follow along and apply to your own operations.

Example 1: Setting Prices for a Premium Support Service

Imagine a software company, let's call them "InnovateTech," wants to launch a new premium support tier. They can't just pick a price out of thin air; they need to ensure the service is actually profitable. Their goal is a healthy 40% profit margin.

First, InnovateTech needs to figure out the total monthly cost to run this new service. This isn't just salaries; it includes specialized software for the agents and a slice of the company's overhead.

- Total Monthly Cost: AED 60,000

- Target Profit Margin: 40% (or 0.40)

To hit their target, they need to figure out the total revenue (the selling price) they must generate. For this, we'll use a slightly rearranged version of the profit margin formula:

Selling Price = Cost / (1 - Target Profit Margin)

- Step 1: First, subtract the target margin from 1.

1 - 0.40 = 0.60 - Step 2: Now, divide the total cost by that result.

AED 60,000 / 0.60 = AED 100,000

InnovateTech must bring in AED 100,000 in monthly revenue from this new support tier to hit its 40% profit margin target. This single number becomes the foundation for their entire pricing strategy, helping them decide on everything from individual seat prices to bundled package deals.

Example 2: Evaluating the ROI of Outsourcing

Next up, let's look at an e-commerce brand called "Desert Blooms." They're considering outsourcing their customer inquiries to a BPO partner and want to compare the profitability of their current in-house team against the BPO's proposal.

The BPO has quoted them a flat fee of AED 45,000 per month. Desert Blooms estimates that their customer service efforts protect about AED 120,000 in monthly revenue by saving orders and retaining customers. Meanwhile, their current in-house support team costs AED 80,000 per month to run.

Let's run the numbers and calculate the profit percentage for both options.

In-House Team:

- Calculate Profit:

AED 120,000 (Revenue) - AED 80,000 (Cost) = AED 40,000 - Calculate Profit Margin:

(AED 40,000 / AED 120,000) * 100 = **33.3%**

Outsourced BPO Team:

- Calculate Profit:

AED 120,000 (Revenue) - AED 45,000 (Cost) = AED 75,000 - Calculate Profit Margin:

(AED 75,000 / AED 120,000) * 100 = **62.5%**

The comparison is crystal clear. Outsourcing would more than double their profit margin on customer service operations. This kind of data-driven insight empowers them to make a confident, strategic decision. An analysis like this also has a positive ripple effect on cash flow—a metric closely tied to the Days Sales Outstanding formula—since lower operational costs free up capital faster.

Profit Margin vs Markup What You Need to Know

In the world of business finance, two terms get tossed around and confused more than any others: profit margin and markup. People often use them interchangeably, but that's a critical mistake. While both are vital signs of your business's health, they measure completely different things.

Confusing them can lead to flawed pricing strategies, inaccurate financial reports, and a genuine misunderstanding of how much money you're actually making.

The core difference is surprisingly simple. Profit margin measures your profit as a percentage of the selling price, while markup measures that same profit as a percentage of your cost. Think of it this way: margin tells you what slice of the revenue pie you get to keep, while markup shows you how much you inflated the price from what it cost you.

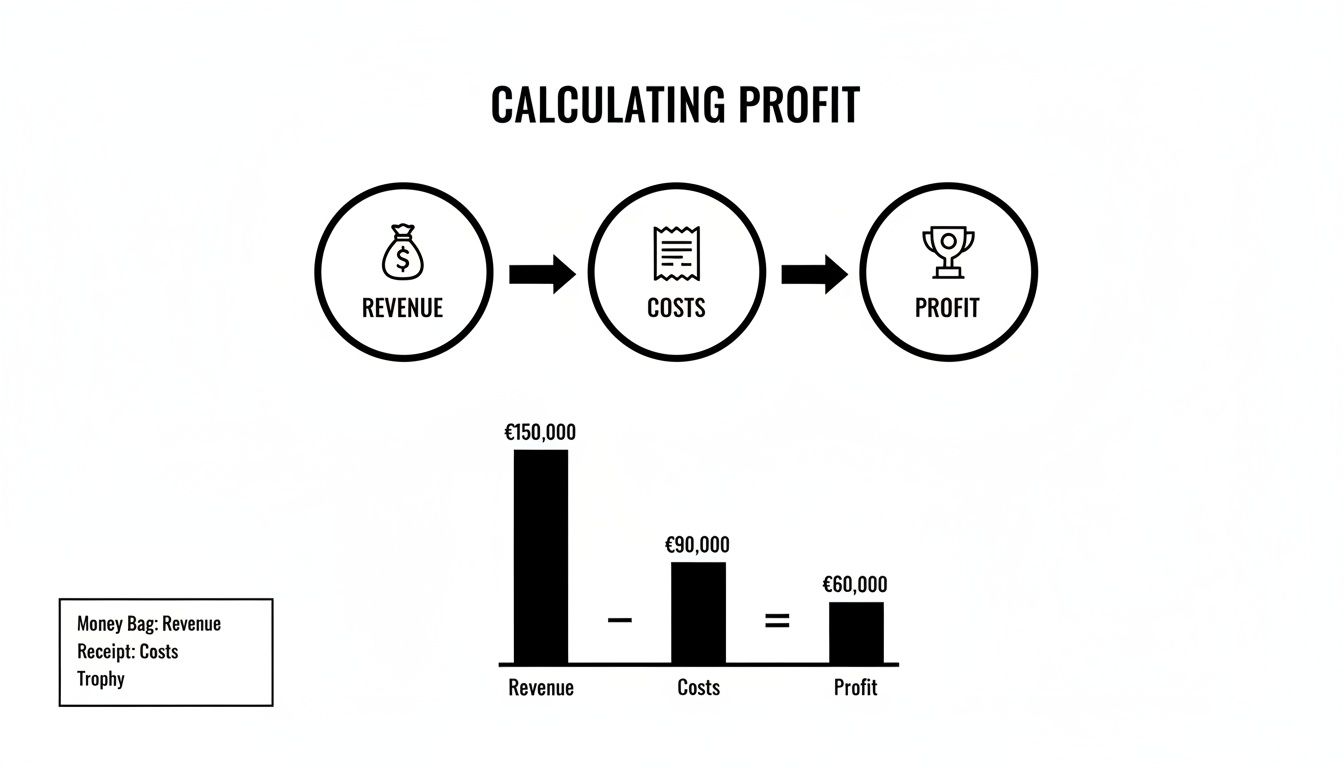

This diagram breaks down the basic flow from revenue to profit.

It's a straightforward visual, but it's the foundation for both calculations: profit is what’s left after you subtract your costs from the money you brought in.

Profit Margin vs Markup A Practical Comparison

The best way to see the difference is with a real-world example. Let's imagine you offer a specialized customer support service. It costs you AED 100 to deliver this service, and you charge your client AED 150.

This simple table lays out how the two metrics see the exact same transaction very differently.

| Aspect | Profit Margin | Markup |

|---|---|---|

| Formula | (Profit / Revenue) × 100 |

(Profit / Cost) × 100 |

| Focus | Profitability relative to the selling price. Answers: "What percentage of my revenue is profit?" | Profitability relative to the cost. Answers: "How much did I increase the price over my cost?" |

| Example Calculation | Your profit is AED 50. The formula is (50 / 150) × 100. |

Your profit is AED 50. The formula is (50 / 100) × 100. |

| Result | 33.3% | 50% |

| Primary Use Case | Evaluating overall business efficiency and health. The metric investors and analysts care about. | Internal pricing decisions. Used to ensure each sale covers its costs and contributes to profit goals. |

So, for the exact same service, you have a 50% markup but only a 33.3% profit margin. This stark contrast is why understanding the difference is non-negotiable for anyone pricing contracts or evaluating financial performance. One number makes you feel great; the other tells you the reality of your business's efficiency.

Markup is typically an internal tool used to set prices, making sure every sale covers its costs and adds to the bottom line. Margin, on the other hand, is the true indicator of how efficiently your business turns revenue into actual profit. It's the number investors and lenders will be looking at.

This distinction is especially crucial in the booming business process outsourcing (BPO) world. The BPO market across the MENA region is set to explode, growing at a CAGR of 14.5% through 2030, and it's all driven by financial efficiency. Companies that outsource can slash costs by up to 60%, which dramatically rewires their profit percentage equation. This shift can push average profit margins for contact centers from a modest 10% to a much healthier 28%. You can discover more insights about the MENA BPO market to dig deeper into these trends.

Using Profit Calculations for Strategic Decisions

Knowing your profit percentage equation isn't just a financial box-ticking exercise. It's about turning a simple number into a powerful tool for making smarter business decisions. Once you nail down how to calculate profit, you can use it to shape strategy, from setting prices to evaluating massive operational shifts like outsourcing.

Instead of being a backward-looking metric, profit calculations become your forward-looking guide. They help you model different scenarios, justify investments, and build a more resilient and scalable operation. Let's dig into how to apply these calculations to real-world strategic challenges.

Structuring Profitable Service Pricing

One of the most direct ways to use the profit percentage equation is for setting prices on your services, especially complex offerings like tiered support or service level agreements (SLAs). Just guessing at a price or blindly matching competitors is a recipe for disaster.

A data-driven approach starts with your costs. First, you have to calculate the total cost of delivering a specific service—that means everything from agent time and software seats to a slice of overhead. Once you have a clear cost baseline, you can work backward from your target profit margin to find the ideal selling price.

Let's say a premium support SLA costs your business AED 5,000 per month to deliver, and you're aiming for a 40% profit margin. You can use this formula:

Selling Price = Cost / (1 - Target Profit Margin)

The math would be AED 5,000 / (1 - 0.40), which equals AED 8,333. This becomes your minimum viable price to hit your profitability goals, grounding your entire pricing strategy in solid financial logic.

Evaluating Outsourcing ROI with Confidence

Deciding whether to outsource your customer service is a massive strategic move. The profit percentage equation is your best friend here, letting you move past vague promises of "cost savings" to analyze the real financial impact.

The process is a head-to-head comparison. You calculate the profit margin of your current in-house team and stack it up against the projected margin with a BPO partner. This demands a thorough breakdown of every single associated cost for both scenarios. If you want a deep dive on this, check out our guide on evaluating the cost savings of outsourced vs in-house support teams.

This kind of strategic thinking is especially relevant in the UAE, a major hub for customer service outsourcing. Businesses there have seen huge gains by using the profit percentage equation to guide their BPO adoption. By outsourcing customer care, many companies have slashed operational costs by 30-50%. As a result, some SMEs in Dubai have watched their profit margins jump from 12% to 22% after making the switch.

Planning for Long-Term Contract Profitability

Finally, the profit percentage equation is a vital tool for planning long-term contracts and partnerships. When you sign a multi-year deal with a client or a vendor, the initial cost and revenue figures are just the starting line. Costs can creep up, and the scope of work can change over time.

By regularly recalculating the profit margin on key contracts, you can proactively identify partnerships that are becoming less profitable. This allows you to renegotiate terms, adjust service levels, or plan your exit strategy before the contract becomes a financial drain.

This continuous monitoring turns your profit calculations into a dynamic management tool. It ensures every major business relationship keeps contributing positively to your bottom line, safeguarding the long-term financial health of your operations.

Even with the right profit percentage equation in hand, it’s surprisingly easy for small calculation errors to snowball into major strategic blunders. A flawed profit figure can trick you into overpricing your services, underestimating the cost of an outsourcing partner, or completely misjudging the financial health of your business.

Think of it like navigating with a faulty compass. A tiny one-degree error might not seem like much at first, but over a long journey, it can send you miles off course. An inaccurate profit calculation does the same thing—it steers your business in the wrong direction, leading to costly corrections down the line.

Let's break down the most common mistakes I see teams make and how you can steer clear of them.

Overlooking Hidden Costs

One of the most frequent errors is failing to account for all expenses. It's easy to remember the obvious, direct costs like agent salaries or the monthly BPO invoice. But the indirect, "hidden" costs are the ones that are often forgotten, and these omissions can drastically inflate your perceived profitability.

You end up with a dangerously misleading picture of your finances.

Commonly missed costs include :

- Software Overheads : The per-seat cost of your CRM, ticketing system, and communication tools adds up quickly.

- Management Time : A portion of leadership and admin salaries is always dedicated to overseeing customer service.

- Training and Onboarding : Don't forget the resources spent getting new agents up to speed and providing ongoing development.

What to Do Instead : Create a comprehensive checklist of every possible expense tied to your service delivery. Review it quarterly to make sure you’re capturing everything from software licenses to the prorated cost of administrative support. A complete cost picture is non-negotiable for an accurate profit calculation.

Confusing Gross and Net Profit

Another classic mix-up is using gross profit figures when you should be looking at net profit. Gross profit only subtracts the direct cost of goods sold (COGS), which gives you a high-level, often rosier, view of profitability. The problem is, it ignores all your other operating expenses.

Net profit, on the other hand, accounts for every business expense—operating costs, taxes, interest, the works. It shows you the true, bottom-line result of your operations.

Basing big decisions on gross profit alone is like planning a household budget by only looking at your salary and ignoring rent, utilities, and groceries. It’s an incomplete and totally unreliable approach.

Misinterpreting Short-Term Data

Finally, a single month of data is just a snapshot, not the whole movie. A particularly good or bad month can easily be an anomaly, perhaps caused by seasonal demand, a one-off project, or an unexpected expense. Relying on this short-term data to make long-term strategic decisions is a recipe for disaster.

For example, seeing a 30% profit margin in December might feel great, but it was likely driven by a holiday sales surge, not sustainable operational efficiency. If you make staffing or pricing changes based on that one data point, you could find yourself in a tough spot when business returns to normal in January.

What to Do Instead : Always analyze trends over a longer period, like a quarter or even a full year. This approach smooths out the peaks and valleys, giving you a much more reliable and accurate understanding of your true profitability and performance.

Frequently Asked Questions

As you start using the profit percentage equation in your own operations, you’ll naturally run into some practical questions. This section cuts straight to the chase with clear answers to the most common queries, giving you the confidence to move from theory to real-world application.

Think of it as a quick reference guide to keep in your back pocket.

How Often Should I Calculate My Profit Percentage ?

The right answer really depends on what you're trying to accomplish. There's no single magic number, but setting a consistent rhythm will give you the best insights for both day-to-day decisions and long-term planning.

Here’s a cadence that works for most service businesses:

- Monthly for Operational Reviews: A monthly calculation is like taking a regular pulse check on your business health. It helps you spot worrying trends early—like rising software costs or a dip in team efficiency—so you can make adjustments before small issues snowball into bigger problems.

- Quarterly for Strategic Planning: Looking at your numbers every quarter smooths out any weird monthly blips and gives you a much more reliable picture. This is the perfect timeframe for making bigger calls, like deciding whether to renew a vendor contract or setting the budget for the next quarter.

When you monitor it regularly, the profit percentage equation stops being just a static number and becomes a dynamic tool for getting better all the time.

Can a Profit Percentage Be Negative ?

Absolutely, and when it is, it's a critical red flag that needs your immediate attention. A negative profit percentage simply means your costs were higher than your revenue for that period. In other words, you took a loss.

In a customer service setting, this could happen if a major client unexpectedly cancels a high-value contract mid-month. Or maybe you had to pour a ton of money into unplanned agent training and overtime to handle a sudden product recall.

If your calculation comes out negative, the first thing to do is figure out why. Dig into your cost and revenue data for that period to pinpoint what went wrong. Was it a one-off expense, or is it a sign of a deeper issue you need to fix?

What Is a Good Profit Percentage for a Service Business ?

This is probably the most common question I hear, but the truth is, there's no universal "good" number. The answer depends entirely on your specific industry, business model, and scale. A lean, highly automated SaaS company might shoot for a gross margin of 70-80%, while a hands-on consulting firm could be incredibly successful with a 30-40% margin.

Instead of getting hung up on a generic target, focus on these two things:

- Industry Benchmarks: Do a little research to see what typical profit margins look like for businesses similar to yours. This gives you a realistic baseline to work from and helps you set goals that actually make sense.

- Your Own History: Honestly, your most important benchmark is your own past performance. The goal should always be to maintain or, even better, improve your profit percentage over time. That’s the real proof that your operations are becoming more efficient.