In the competitive landscape of banking, customer satisfaction serves as a pivotal factor influencing customer loyalty. In today’s digital age, where account switching is as easy as a few clicks, maintaining high levels of customer satisfaction is no longer optional — it’s essential. Banks that prioritize and foster a customer-first strategy will not only retain clients longer but will also benefit from positive word-of-mouth and repeat business. This article explores the intricate relationship between customer satisfaction and customer loyalty, with a specific focus on the banking industry, highlighting the tactics financial institutions can deploy to bolster both.

The Role of Customer Satisfaction in Banking

Customer satisfaction in banking is influenced by various factors, including service quality, technological convenience, and personalized experiences. At its core, customer satisfaction measures whether a bank’s products and services meet or exceed customer expectations. In a sector characterized by high competition, even minor lapses in service can result in losing customers to a more client-centric competitor. For instance, if a bank consistently delivers seamless mobile banking services and efficient customer support, it is more likely to retain its clientele.

Understanding Customer Loyalty

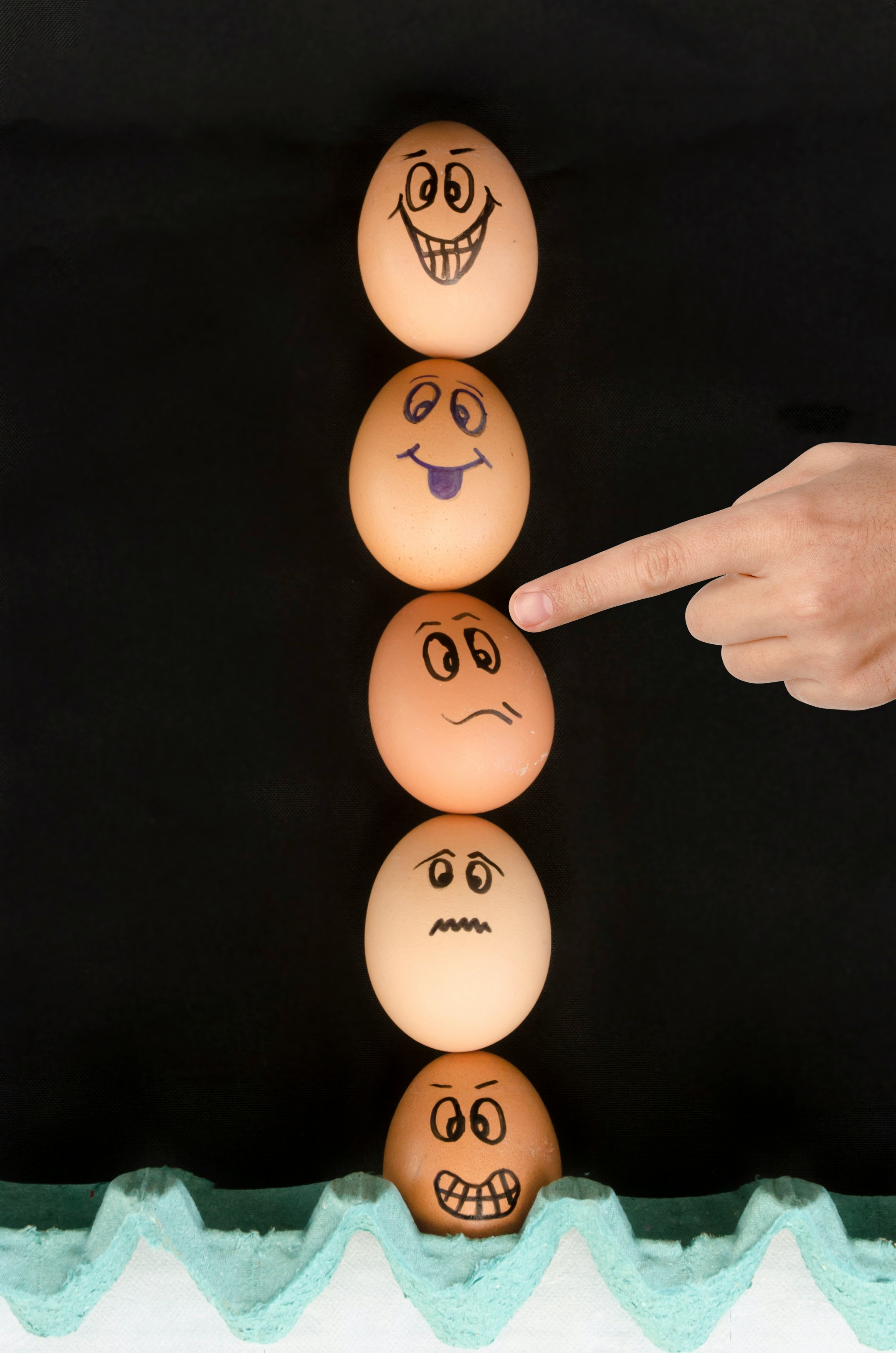

Customer loyalty in the banking industry is defined by a customer's willingness to continue using a bank's services, not merely out of necessity, but by choice. Loyalty typically manifests in two forms: attitudinal loyalty, where customers have a sincere affection for the bank, and behavioral loyalty, where customers consistently choose the bank over others. High customer satisfaction is often a precursor to customer loyalty as satisfied customers tend to demonstrate a higher likelihood of staying with their current provider and possibly recommend it to others.

The Impact of Technological Innovations

The advent of digital banking has revolutionized customer interactions, with technology playing a crucial role in enhancing customer satisfaction. For example, mobile banking apps offer the convenience of performing transactions anytime and anywhere, significantly impacting how customers perceive banking services. Features such as instant transaction alerts, digital lending, and AI-driven financial advice have contributed to increased customer satisfaction, which subsequently strengthens customer loyalty. Banks that harness technology effectively can better meet customer needs, fostering a sense of trust and reliability.

The Correlation Between Customer Satisfaction and Customer Loyalty

Research has consistently highlighted a strong correlation between customer satisfaction and customer loyalty. A satisfied customer is more likely to engage in repeated transactions and less likely to switch to competitors. This is particularly relevant in banking, where a high level of trust is necessary. For instance, an exemplary customer service experience, whether in-branch or through digital channels, can significantly impact a client's decision to remain loyal. Moreover, satisfied customers often engage in positive word-of-mouth, acting as informal brand ambassadors and influencing potential clients’ choices.

Strategies to Enhance Customer Satisfaction and Loyalty in Banking

Banks can employ several strategies to improve customer satisfaction and subsequently customer loyalty :

- Personalization: Tailoring services to meet individual customer needs creates a more engaging and satisfying experience. By leveraging customer data analytics, banks can offer personalized banking solutions, enhancing customer satisfaction.

- Robust Customer Support : Providing efficient, 24/7 customer service through multiple channels such as phone, chat, and email ensures any issues are promptly resolved, maintaining customer satisfaction.

- Seamless Omnichannel Experience : Ensuring a seamless experience across all platforms, whether in-person, online, or mobile, strengthens customer trust and satisfaction.

- Feedback Mechanisms : Implementing regular feedback loops via surveys and reviews helps banks understand customer pain points and areas of improvement, demonstrating commitment to customer satisfaction.

- Security Assurance : In an industry centered around trust, ensuring robust data security and fraud prevention measures is paramount to maintaining customer confidence and satisfaction.

Conclusion

Customer satisfaction is an integral component of achieving customer loyalty in the banking industry. By consistently delivering superior service quality and adopting innovative technologies, banks can foster a loyal customer base. Understanding and addressing customer needs, personalizing experiences, and ensuring seamless service across all channels are critical strategies to enhance satisfaction. As banks strive to build long-term relationships with their clients, the focus on customer satisfaction must remain unwavering. By doing so, they not only secure customer loyalty but also fortify their position in an ever-evolving financial landscape, ensuring sustained growth and success.