It measures precisely how quickly your credit sales turn into actual cash in the bank, giving you a sharp signal of your financial efficiency.

What Is Days Sales Outstanding and Why It Matters

Imagine your company's revenue is a garden. Every sale you make on credit is like planting a seed. Days Sales Outstanding, or DSO, is the average time it takes for that seed to grow and for you to harvest the cash. It's a vital sign of your company's financial health, showing how well your entire order-to-cash cycle is working.

A low DSO is great news. It means you're collecting payments quickly and efficiently. This keeps your cash flow healthy, giving you the fuel you need for growth, inventory, and covering operational costs. On the flip side, a high DSO can be a red flag, pointing to underlying problems that need your attention.

The Story Behind Your DSO Number

A rising DSO isn't just a number on a spreadsheet; it’s telling you a story about your operations and customer relationships. It could be pointing to several issues, like:

- Inefficient Billing Processes : Simple mistakes, delays, or confusing invoices can leave customers scratching their heads and pushing back payment dates.

- Lenient Credit Policies : Offering overly generous payment terms might look good for sales, but it can put a real strain on your working capital.

- Poor Collections Strategy : If you're not proactively following up, overdue invoices will pile up, and your DSO will climb right along with them.

- Customer Dissatisfaction : Unhappy customers often delay payments. It’s a common form of protest while they wait for disputes to be resolved.

Because of this, DSO is a critical metric that goes way beyond the finance team. Leaders in operations and customer experience have a direct hand in shaping this number. To really get a handle on DSO, it’s helpful to start by understanding accounts receivable and payable, as both are fundamental to your cash flow.

DSO as a Strategic Business Tool

Keeping a close eye on your DSO is essential for staying liquid and making smart strategic moves. It’s a clear yardstick for how well your accounts receivable team is performing and whether your credit terms are actually working in the real world. The goal isn't just to make sales; it's to turn those sales into cash—the lifeblood of any business. This distinction is a core concept, which you can explore in our guide on revenue vs profit.

For businesses in the UAE, managing this metric is especially important for keeping working capital efficient. Recent regional data shows collections are improving, with the average DSO dropping from 83.9 to 81.1 days. That 3.3% improvement shows a strong focus across the region on speeding up cash conversion cycles. You can discover more insights about regional working capital trends on PWC.com.

A healthy DSO is often a byproduct of an excellent customer experience. When the payment journey is easy, transparent, and respectful, customers are happier and tend to pay faster, strengthening both your cash flow and your brand reputation.

How to Calculate DSO Using the Standard Formula

Calculating your Days Sales Outstanding doesn't require a degree in advanced mathematics. Think of the standard days sales outstanding formula as a simple yet powerful tool for taking your business’s financial pulse. It gives you a clear snapshot of how efficiently you're turning invoices into cash.

The formula itself is pretty straightforward:

DSO = (Total Accounts Receivable / Total Credit Sales) x Number of Days in Period

In simple terms, this calculation tells you, on average, how many days it takes for your company to get paid after making a sale on credit. Let’s break down each piece of that puzzle so you can use it with confidence.

Breaking Down the Formula Components

To get an accurate DSO number, you have to be precise about what each part of the formula represents. Plugging in the wrong numbers is a common pitfall that can lead to some seriously flawed business decisions.

Before you start crunching numbers, let's get crystal clear on the three key ingredients you'll need.

DSO Formula Components Explained

| Component | Definition | Example for Calculation |

|---|---|---|

| Total Accounts Receivable | The sum of all unpaid customer invoices at the end of the period. | AED 50,000 in outstanding invoices |

| Total Credit Sales | The total value of sales made on credit during the period (excluding cash sales). | AED 300,000 in quarterly sales |

| Number of Days | The length of the measurement period in days. | 90 days for a quarterly calculation |

Getting these components right is non-negotiable. For instance, including cash sales in your "Total Credit Sales" would artificially lower your DSO, giving you a false sense of security about your collections process.

A Practical Example of the DSO Formula

Abstract formulas are one thing, but seeing the numbers in action is what really makes the concept stick. Let's walk through a realistic scenario for a business consultancy operating here in the UAE.

Imagine "Innovate Consulting" wants to figure out its DSO for the last quarter (Q3). Here are its books:

- Total Accounts Receivable at the end of Q3: AED 250,000

- Total Credit Sales during Q3: AED 750,000

- Number of Days in the period (Q3): 90

Now, we just plug these figures into our standard days sales outstanding formula.

- First, divide your Accounts Receivable by your Credit Sales: AED 250,000 / AED 750,000 = 0.333

- Next, multiply that result by the Number of Days: 0.333 x 90 days = 30 days

The result is a DSO of 30 days. This means, on average, it takes Innovate Consulting exactly one month to collect payment after sending an invoice.

If their standard payment term is Net 30, they're in great shape. But if their terms are Net 15, this DSO of 30 signals a 15-day delay in their collections cycle—something that definitely needs a closer look. This simple calculation gives them a clear, actionable starting point for improving their cash flow.

What a Good DSO Number Actually Looks Like

So, you’ve run the days sales outstanding formula and have a number in front of you. Now what? The big question is, is it any good? It's tempting to hunt for a universal, magic DSO number that signals you’re doing great. But the truth is, a "good" DSO isn't a single figure—it's a moving target that hinges entirely on your business.

There’s simply no one-size-fits-all answer. The ideal DSO can swing wildly depending on your industry, business model, customer base, and even where you operate. What’s fantastic for a retail business collecting cash upfront would be a complete disaster for a construction firm with long project timelines and milestone payments.

The Most Important Benchmark : Your Payment Terms

Before you even glance at industry averages, your most important benchmark is the one you set yourself: your payment terms. Your DSO is the story of how your actual collections are performing against your own expectations.

If your standard invoice term is Net 30 (meaning, payment is due in 30 days) but your DSO is consistently sitting around 45 days, you've got a clear performance gap. That 15-day lag represents cash that's tied up—cash that could be fueling growth, paying suppliers, or just strengthening your financial footing. This gap is your immediate call to action.

The primary goal isn't just to hit a low DSO, but to get your DSO as close as possible to your stated payment terms. A DSO that lines up with your terms signals a healthy, predictable, and efficient accounts receivable process.

When those numbers align, it shows that your customers understand and respect your terms, and your collections process is humming along nicely. A big gap, on the other hand, is a flashing red light that there's friction somewhere in your order-to-cash cycle that needs fixing.

The Hidden Stories in High and Low DSO

A DSO figure is never just a number; it’s a symptom of what’s happening on the ground in your operations. Both high and low values can tell you something critical about your business, and it’s not always what you’d expect.

A high DSO is the usual suspect and a common headache. It puts a direct strain on your cash flow and can point to several potential problems:

- Inefficient Collections : Your follow-up process might be too slow, inconsistent, or just not equipped with the right tools to get the job done.

- Customer Financial Distress : Your clients might be struggling with their own cash flow, which means they're paying you later.

- Disputes and Errors : Unresolved issues with invoices or service delivery are a classic cause of payment delays. Customers won’t pay for something they believe is wrong.

- Lenient Credit Policies : You might be extending credit to customers who aren't really creditworthy, ratcheting up your risk of late payments.

On the flip side, an unusually low DSO isn't automatically a reason to celebrate. Sure, it means cash is hitting your bank account fast, but it could also be a red flag for other issues:

- Overly Strict Credit Terms : Your credit policy might be so tight that you're scaring away perfectly good customers and strangling your sales growth.

- Excessive Early Payment Discounts : Are you giving away too much of your profit margin just to get paid a few days earlier? It might not be worth it.

- Damaged Customer Relationships : A super-aggressive collections strategy can get you paid quickly, but it can also burn bridges with loyal customers.

Juggling your collections process and customer relationships effectively is a delicate art. Getting a handle on the key metrics that drive success here can offer much deeper insights. For a wider view, you might find our guide on the top 10 customer service KPIs to track in 2025 helpful.

Ultimately, interpreting your DSO means looking past the number and understanding the strategic trade-offs you're making between cash flow, sales growth, and customer satisfaction. It's all about striking the right balance that sets your company up for sustainable, long-term success.

Common Mistakes That Distort Your DSO Calculation

Getting your Days Sales Outstanding calculation wrong is often worse than not calculating it at all. When you build strategies on top of faulty data, you're flying blind. You risk making poor decisions on everything from your credit policies and collection tactics to your all-important cash flow forecasts. The days sales outstanding formula itself is straightforward, but its accuracy hinges entirely on the quality of the numbers you plug into it.

Even tiny errors can snowball, warping the final figure and hiding serious problems under the surface. Getting this metric right means staying vigilant against the common pitfalls that can throw your calculations off track. Let's pull back the curtain on the frequent mistakes that can skew your results, giving you a false sense of security or causing unnecessary panic.

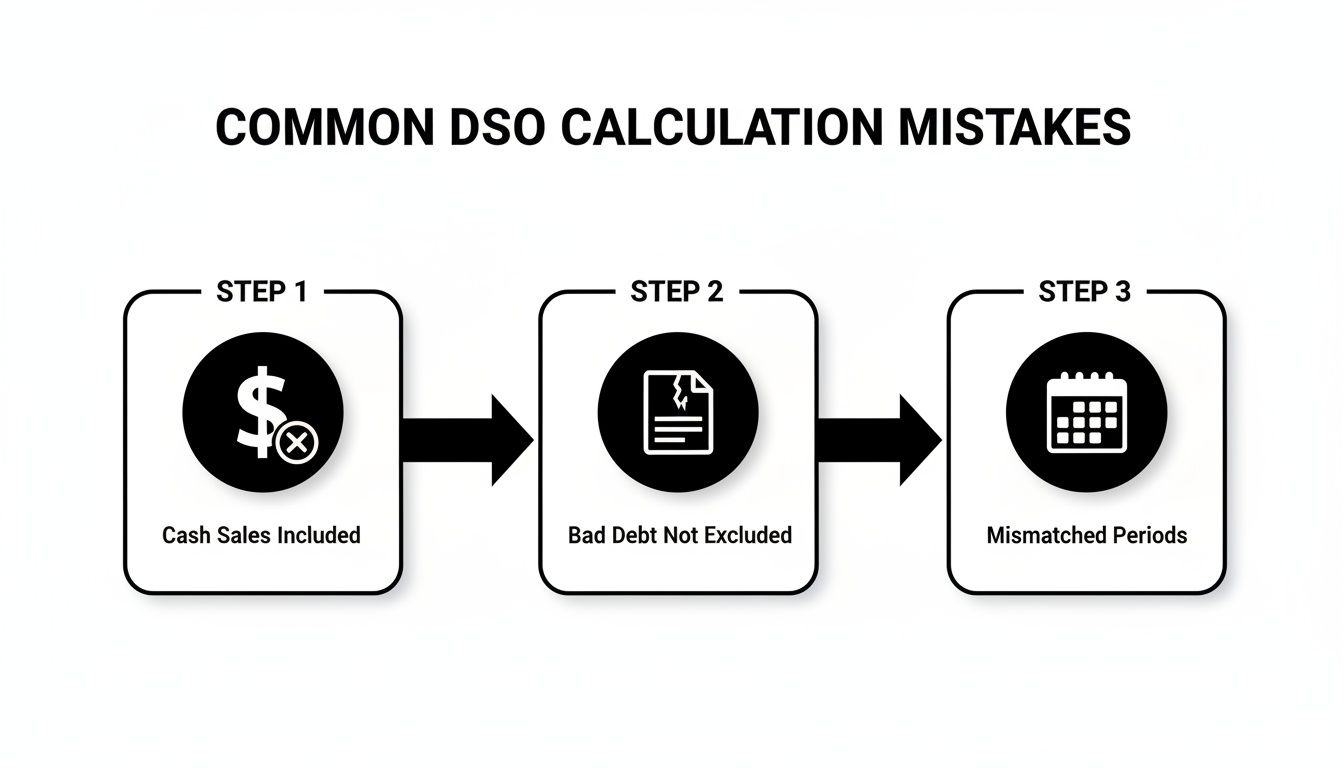

Mismatched Calculation Periods

One of the easiest traps to fall into is a simple mismatch of timelines. The "Total Accounts Receivable" and "Total Credit Sales" figures you use absolutely must cover the exact same period. It's a common slip-up to grab an end-of-quarter accounts receivable balance but use credit sales data from the last 90 days, which might not line up perfectly with the quarter's actual start and end dates.

This kind of inconsistency will dramatically skew your DSO. Imagine you have a massive sales month right at the end of the quarter. Your accounts receivable will shoot up, but if your sales period is even slightly off, the calculation will be completely distorted. Always double-check that the start and end dates for both your receivables balance and your total credit sales are perfectly in sync.

An accurate DSO isn't just another financial metric; it’s a direct reflection of your operational discipline. Keeping your data clean, consistent, and correctly categorized is the bedrock for turning DSO from a simple number into a powerful business insight.

Incorrectly Including Cash Sales

The days sales outstanding formula was built for one specific job: to measure how efficiently you collect payments on sales made on credit. It tells you how long it takes to turn an invoice into actual cash, not how you're doing on all sales. A critical error is dumping cash sales into the "Total Credit Sales" part of the equation.

Because cash sales are collected on the spot, mixing them in artificially pumps up your total sales number without adding a dime to your receivables. This will make your DSO look much lower—and healthier—than it really is. It effectively masks any sluggishness in your credit and collections process, painting a dangerously misleading picture of your cash flow.

- Correct : Only use sales made on credit for the calculation period.

- Incorrect : Using total revenue, which lumps both credit and cash sales together.

Ignoring the Impact of Bad Debt

Perhaps the most damaging mistake is letting uncollectible invoices—your bad debt—just sit and fester in your accounts receivable. These are the invoices you have little to no real chance of ever collecting. As long as they remain on your books, they artificially inflate your "Total Accounts Receivable" balance, day after day.

This makes your DSO creep higher and higher, suggesting your team is taking longer to collect payments when the real issue is that some of your invoices are dead weight. This not only distorts a key performance metric but can also lead to misguided collection efforts, with your team wasting precious time chasing money that will never arrive. Regularly writing off bad debt is essential for getting a true picture of your collection efficiency. The process of identifying uncollectible debt is a crucial part of financial compliance, where even small errors can have significant consequences. You can learn more about the cost of these errors by understanding what false positives in financial compliance are costing you.

This challenge is especially relevant in the UAE, where B2B payment behaviors directly impact receivables. Recent data reveals that overdue invoices affect 58% of B2B sales in the region, while a staggering 8% are written off as bad debts. This really underscores how unmanaged receivables can severely distort DSO if they aren't accounted for properly. You can find out more about UAE B2B payment trends from Atradius.

Actionable Strategies to Improve Your DSO

Knowing your Days Sales Outstanding is one thing; actually lowering it is where you start seeing real improvements in your cash flow. And here’s a secret: improving DSO isn’t just a job for the finance team. It’s a company-wide mission that relies on sharp operations and a great customer experience. In fact, a lower DSO is often just a happy side effect of making it easier and more pleasant for customers to pay you.

This section is all about practical, real-world strategies that any team can put into play to shrink that order-to-cash cycle. From cleaner invoicing to more human collections, the theme is simple: a customer-first mindset is the best tool you have for boosting your financial health.

Before we dive in, this visual highlights some common tripwires that can throw off your DSO calculation, like mixing up cash sales, mishandling bad debt, or using mismatched time periods for your data.

Each of these mistakes can artificially inflate your accounts receivable or misrepresent your sales, giving you a misleading DSO that might be hiding serious collection problems under the surface.

Refine Your Invoicing for Clarity and Speed

Honestly, the biggest reason for late payments often comes down to the invoice itself. If an invoice is confusing, wrong, or shows up late, it creates friction. It gives your customer a perfectly good reason to put it at the bottom of the pile. Your goal should be to make every invoice impossible to misunderstand and dead simple to pay.

Start by making sure every single invoice is 100% accurate before it leaves your system. It needs to have clear line items, the right purchase order (PO) number, and a breakdown of any taxes or fees. And get it out the door immediately after you deliver the goods or finish the service—a delayed invoice is a delayed payment.

To cut out even more friction, nail these invoicing basics:

- Standardize Templates : Use a clean, consistent template that puts the due date, total amount, and your payment details front and center.

- Include Clear Instructions : Don't make them guess. Spell out exactly how they can pay, whether it's a bank transfer, credit card, or an online portal.

- Confirm the Recipient : Always send the invoice straight to the person or department in charge of paying it, like accounts payable. This stops it from getting lost in someone's inbox.

Adopt Proactive and Empathetic Collections

The word "collections" probably brings to mind aggressive phone calls, but the modern approach is built on helpfulness and open communication. The best collection strategies are proactive, not reactive. They begin long before an invoice is even due, positioning the whole process as a customer service function designed to help clients succeed.

This is as simple as sending a friendly reminder a few days before the due date. This small gesture works as a helpful nudge and confirms the customer has everything they need. It also opens a door for them to flag any potential issues early on.

A proactive, customer-centric collections process doesn't just get you paid faster; it strengthens relationships. When customers feel supported instead of chased, they are more likely to prioritise your invoices and remain loyal clients.

Once an invoice is officially overdue, keep your tone respectful and focused on solutions. The aim is to figure out why there's a delay and find a way forward together. An aggressive approach can wreck a valuable customer relationship and often doesn't even work.

Streamline Your Dispute Resolution Process

An unresolved dispute is a guaranteed roadblock to payment. When a customer has a problem with an invoice—a pricing error, a question about the service, a delivery issue—they simply won't pay until it's sorted out. A slow, complicated dispute process is a direct cause of a high DSO.

You need to create a clear, fast, and fair system for handling disputes. Assign a specific person or team to own these issues so they don't get bounced between departments. Give that team the power to investigate the problem, communicate transparently with the customer, and issue credit notes or corrected invoices right away.

The faster you resolve a customer's problem, the faster you unlock that stalled payment. A slick dispute process doesn't just lower your DSO; it shows you're committed to customer satisfaction and can turn a potential negative into a real positive.

Embrace Technology and Automation

Trying to manage every piece of the accounts receivable process by hand is a recipe for mistakes and wasted time. Technology, even simple automation, can make a huge difference to your DSO by making your process more efficient, consistent, and customer-friendly.

Look into tools that can automate the routine stuff, which frees up your team to handle more complex problems and build stronger relationships. Key areas ripe for automation include:

- Automated Reminders: Set up a series of polite, automated emails to go out before and after an invoice is due. This ensures consistent follow-up without anyone having to lift a finger. For managing receivables and cutting down your DSO, think about leveraging automated payment reminders to improve cash flow, which can make this process incredibly smooth.

- Self-Service Payment Portals: Give customers an online portal where they can see their invoices, check their account status, and make payments 24/7. This convenience empowers them to pay you on their own time.

- Electronic Invoicing: Switching from paper or PDF invoices to a fully electronic system can speed up delivery and slash processing errors for both you and your customer.

By putting these customer-focused strategies in place, you can systematically remove the friction from your payment process, encouraging faster payments and driving your DSO down.

Got Questions About the DSO Formula ?

Even with the formula down, you'll likely run into some practical questions when you start calculating DSO for your own business. It happens to everyone. Let's walk through some of the most common ones that pop up.

We’ll cover everything from how often you should be crunching the numbers to what a surprisingly low DSO might be telling you about your sales strategy.

How Often Should I Calculate DSO ?

For most companies, calculating DSO monthly is the sweet spot. It lines up perfectly with your regular financial reporting, so you get a timely snapshot of your collections performance without creating a ton of extra work. A monthly check-in is usually enough to spot a negative trend before it snowballs into a serious cash flow crunch.

Of course, the right rhythm depends on your business. If you’re dealing with a huge volume of daily transactions or running on razor-thin margins, a weekly calculation might give you the tighter control you need. On the flip side, a business with long, complex sales cycles might find that a quarterly review is perfectly fine.

The most important thing? Be consistent. Whether you choose weekly, monthly, or quarterly, stick to it. That consistency is what allows you to compare apples to apples over time and spot meaningful trends.

What Is the Difference Between DSO and DPO ?

Think of Days Sales Outstanding (DSO) and Days Payable Outstanding (DPO) as two sides of the same coin: your company's cash conversion cycle. One tracks the cash coming in, and the other tracks the cash going out.

- DSO (Days Sales Outstanding) : This tells you how fast you collect cash from your customers. It's a direct reflection of how well your accounts receivable team is doing. A lower DSO is almost always better because it means you're getting paid faster.

- DPO (Days Payable Outstanding) : This measures how long you take to pay your own bills to suppliers. It’s all about how you manage your accounts payable. A higher DPO can be a good thing, as it means you’re holding onto your cash longer, which helps with working capital.

Simply put, DSO is about getting paid, while DPO is about paying others. The goal is to find a healthy balance. Stretching your DPO out for too long might look good on paper, but it can easily damage relationships with the suppliers you rely on.

Can a Very Low DSO Be a Bad Sign ?

Absolutely. While a low DSO is what most companies aim for, an extremely low number can be a red flag. It often points to credit policies that are way too restrictive.

If your payment terms are so tough that only the most cash-rich customers can do business with you, you’re probably turning away perfectly good clients and strangling your sales growth. Your sales team could be fighting an uphill battle, losing deals not because of your product, but because the credit requirements are just too high for the average customer in your market.

An unusually low DSO might also mean you're offering early payment discounts that are a little too generous. Sure, these discounts get cash in the door faster, but they could also be needlessly chipping away at your profit margins. The ideal DSO isn't just low—it's low and stable, showing that your collection process is efficient without hurting sales or profitability.

How Does DSO Relate to Customer Experience ?

DSO is a surprisingly powerful, if indirect, measure of your customer experience. Every single step in your billing and payment process is a touchpoint that shapes how customers feel about your company. A smooth, easy process builds confidence; a clunky, confusing one creates friction and, you guessed it, payment delays.

Think about the direct connections here:

- Invoice Clarity : Is your invoice easy to read and understand? A clear, accurate invoice gets paid. A confusing one gets put aside, forcing the customer to call you for clarification.

- Collection Communication : Are your payment reminders helpful and friendly, or do they sound aggressive and demanding? The tone of your collections process can either feel like good customer service or a shakedown.

- Dispute Resolution : How do you handle invoice disputes? A fast, fair, and transparent process shows you respect your customer's business. A slow, bureaucratic nightmare guarantees they’ll hold onto their payment for as long as possible.

Ultimately, a healthy DSO is often the natural result of a great customer experience. When you make the entire financial journey simple, transparent, and respectful, customers aren't just happier—they're also much more likely to pay you on time.